Bitcoin Crashing On Record ETF Outflows

ETF Investors Offloading

The sell off in Bitcoin is showing no signs of letting up with BTC futures plunging lower on Friday. The market is now down almost 17% from the YTD highs, crushing hopes for an ‘UPtober’. Fears over US/China trade relations have had a bruising impact on market sentiment since Trump threatened fresh tariffs last week. A decline in risk assets across the board as well as a record move higher in gold has seen traders exiting BTC longs at a record pace. Along with retail traders exiting positions, institutional investors have been pulling money out of BTC ETFs with industry data showing more than half a billion Dollar’s out of outflows were recorded yesterday alone.

US Regional Bank Concerns

Alongside the uncertainty around a return to the US-China trade war, BTC is also suffering amidst a weakening of risk sentiment in response to troubling US bank data. The S&P 500 regional banks sub-index plunged over 5% yesterday after two lenders reported issues with loans, related to the fraud. The reports spooked investors, fuelling a wave of risk aversion which seen equities, commodities and crypto plunging as traders move into safe-havens such as gold and JPY. With gold continuing to print fresh highs, the current dynamic looks likely to continue near-term, with further pain for bitcoin bulls. The big hope now is that US/China relations take a more constructive turn, otherwise, Bitcoin could have much deeper to run in coming weeks.

Technical Views

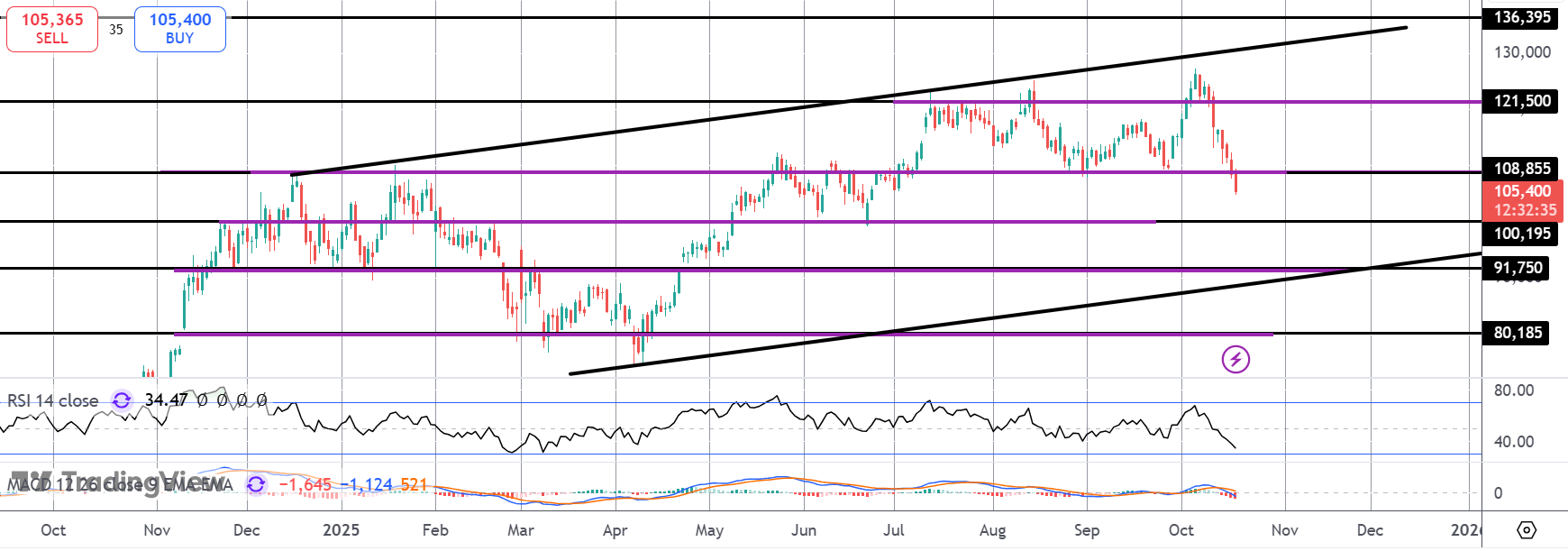

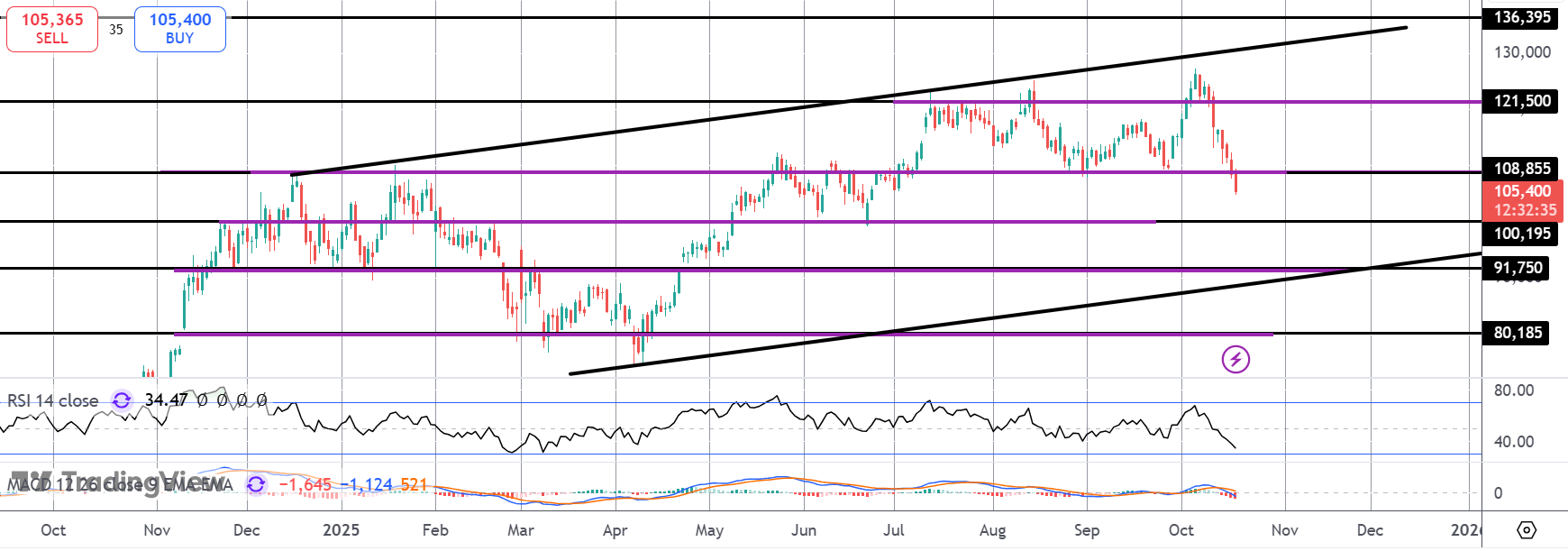

BTC

The reversal lower in Bitcoin is gathering pace now with price breaking below the $108,855 level. Focus is now on the upcoming $100k mark. This is a key psychological level for the market and a break lower could open the way to a much fuller reversal with $91,750 and the bull channel lows the next support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.