Bitcoin: Is UPtober Over Already?

BTC Back Under Pressure

Bitcoin bulls will be watching current price action with plenty of concern. Following a brief period of stabilisation yesterday and some shallow upside, BTC has come back under heavy selling pressure today, breaking down to fresh lows on the month. With BTC futures now down more than 12% from the record highs printed last week, expectations for ‘UPtober’ are under threat. Fresh trade barbs between the US and China have rocked risk sentiment this week with crypto assets suffering heavy losses across the board. Given the heavy liquidation of longs we saw on Friday’s decline, price looked to be stabilising yesterday, suggesting the move was merely a corrective order book clear out. However, with fresh downside momentum today, bulls are now questioning how much further the market can drop.

US/China Trade Threats

The main driver of the move lower here is the return to hostile trade threats between the US and China. As such, the drop can deepen near-term if hostilities remain and can potentially accelerate if Trump makes any sudden moves to lift tariffs. On the other hand, if Trump walks back tariff threats or the two sides note fresh attempts to negotiate, this should fuel a sharp rebound in risk sentiment, lifting BTC prices again.

Big Names Still Buying

Despite the drop lower, big names are still buying into BTC, positioning for an expected return to upside. Strategy noted its latest purchase this week of a further 220 BTC unites, taking its total holding to 640,250 BTC, worth around $73.6 billion currently.

Technical Views

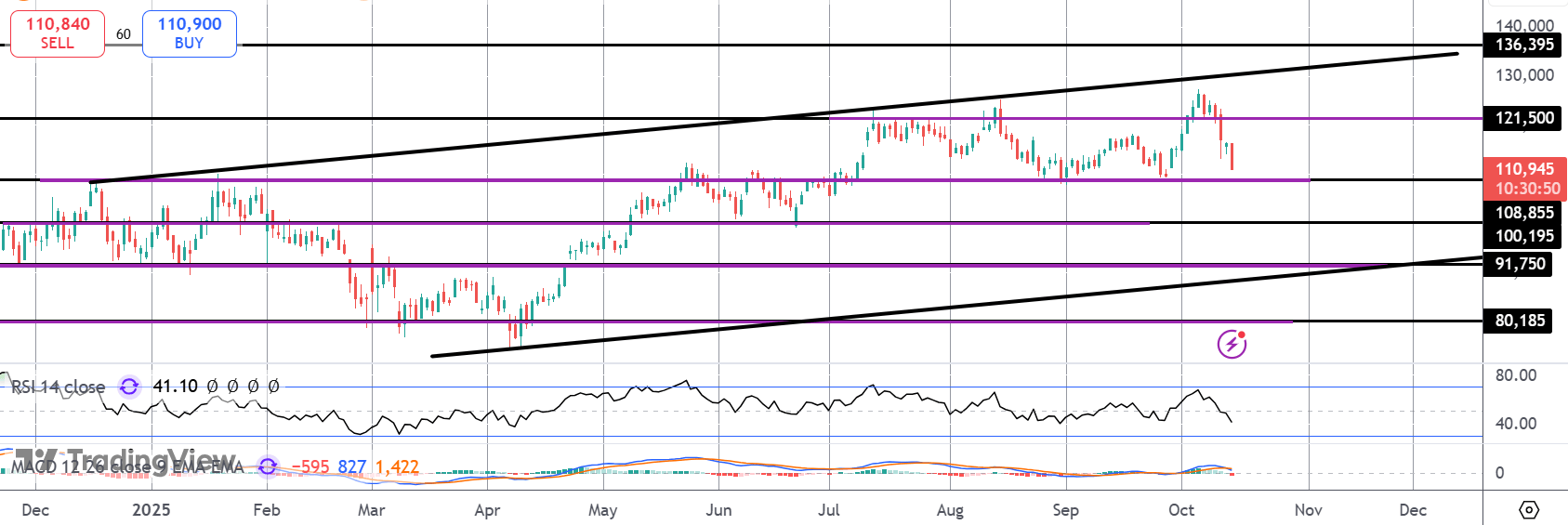

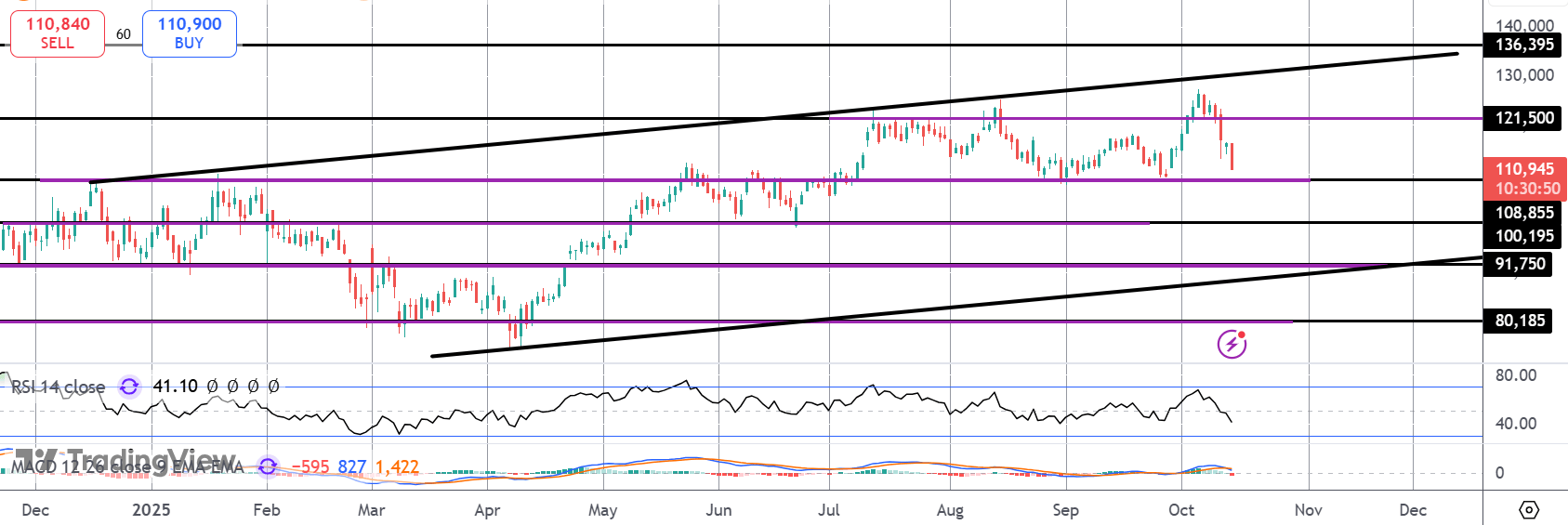

BTC

The reversal lower in BTC has seen the market dumping heavily below the $121,500 level, now fast approaching a test of the $108,855 marker. With momentum studies bearish, risks of a break lower are seen with the key $100k level the main marker to watch if we do continue lower here. Bulls will need to defend that level to prevent a sharp bearish shift in sentiment and expectations.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.