Bitcoin Stabilises Following Friday's Crash

BTC Plunges on Trump Threats

Bitcoin is on watch this week following a heavy rout on Friday as risk markets tumbled in response to fresh tariff threats from Trump on China. BTC futures plunged almost 8% on the day wiping out around $18 billion in long positions before price stabilised and regained some ground. For now, the market is still down more than 8% from last week’s all-time highs and traders are wondering whether the move is merely a correction or the start of a deeper reversal lower.

Investment Giant Warns on Crypto

Amidst the chaos on Friday, investment giant Hargreaves Landsdown issued a fresh warning over Bitcoin saying that it doesn’t deem BTC an asset class and crypto in general doesn’t meet its criteria to be included in investment portfolios. This comes on the back of the recent lifting of a long-held ban from UK regulators on Uk investors accessing crypto ETNs. The move by the UK government has opened the crypto market up to the winder mainstream UK market including a new ruling that crypto ETNs can also be held in ISAs. In particular HL warned against the volatility of the market, as evidenced on Friday.

Order-Book Clear Out

Traders are now watching to see if the rebound from Friday can continue early this week. Given that leveraged positions were known to be extended into the recent push higher, the move has the hallmarks of an order-book clear out, setting the stage for a fresh rally. Given that seasonal expectations for Q4 returns are firmly bullish, the move could present a good opportunity for those looking to position for another leg higher.

Technical Views

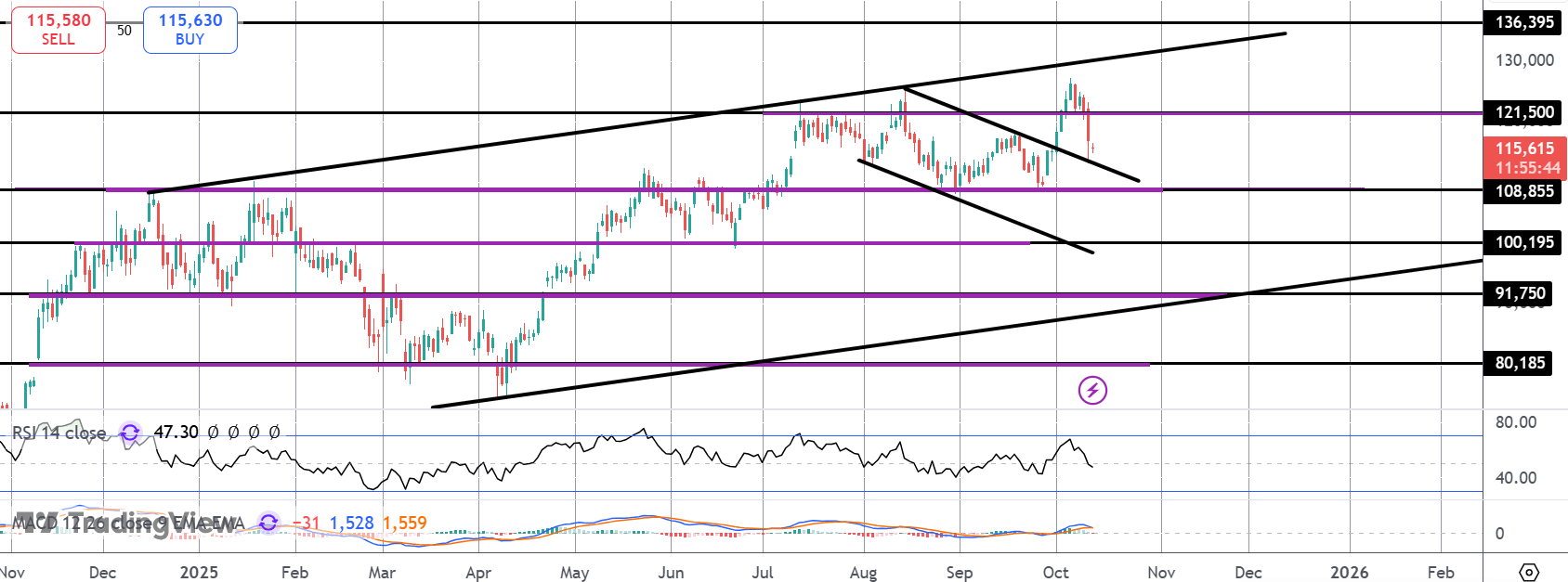

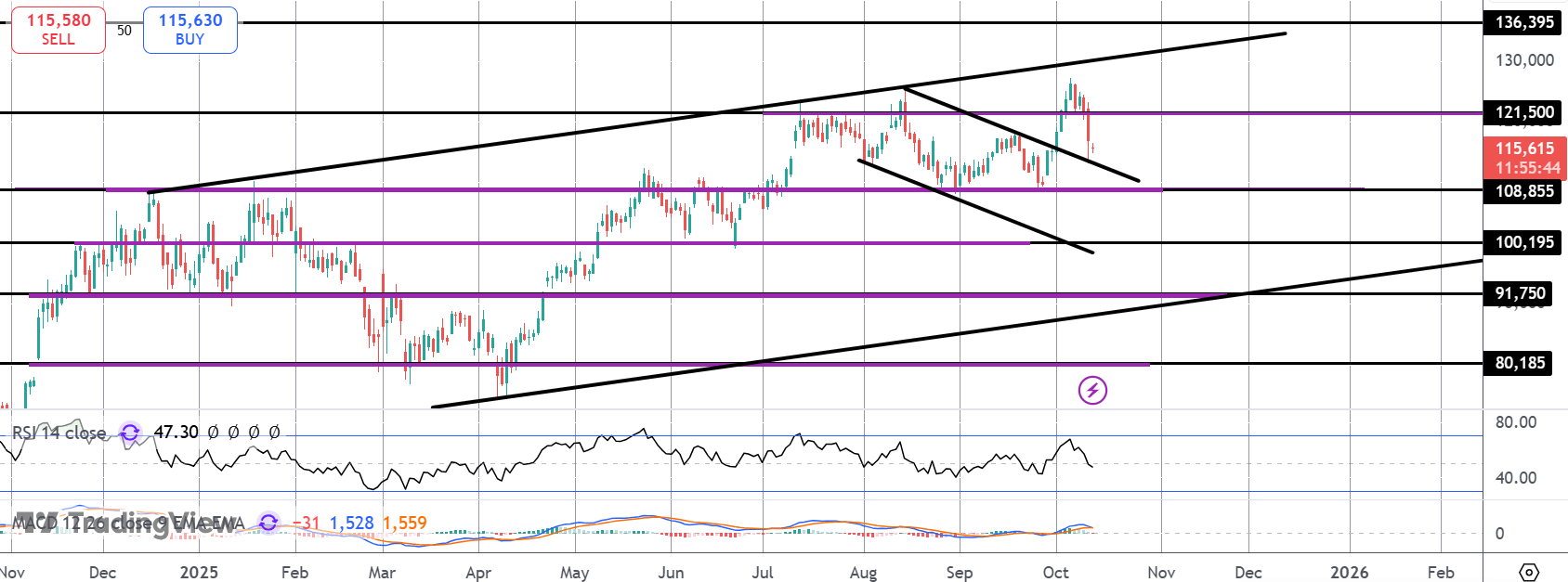

BTC

The market has fallen heavily back under the $121,500 level with risk of a double top now seen. $108,855 will be the pivotal level to watch (potential neckline), with a break there opening the way for a deeper move targeting $100k initially. While that level holds, however, focus is on a recovery and an eventual break higher with $136,395 the next bull target.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.