FTSE 100 FINISH LINE 16/10/25

FTSE 100 FINISH LINE 16/10/25

London stocks started Thursday flat following GDP data that met expectations, as investors treaded cautiously amidst ongoing inflation worries and mixed corporate updates. However, optimism resurfaced by the session's end, nudging the benchmark index into modestly positive territory. The UK economy recorded a slight 0.1% growth in July, aligning with analyst forecasts. While this minor uptick offers some breathing room for Finance Minister Rachel Reeves ahead of the November budget, it is unlikely to stave off the anticipated tax hikes investors are bracing for. The nation continues to grapple with sluggish economic momentum and the highest inflation rate among developed economies. The British pound hit a seven-day high of 1.3455 after UK August GDP data. In contrast, the U.S. faces delays in economic updates due to a government shutdown. Traders await UK inflation data on October 22 and the U.S. CPI report on October 24. Market sentiment is mixed, with less than a 50% chance of a Bank of England rate cut this year, while the Federal Reserve is projected to ease by 47 basis points, per LSEG's IRPR data.

Among individual stocks, Croda International shone with a 1.9% rise to 2,721 pence, emerging as one of the standout performers on the FTSE 100, which slipped 0.2%. The speciality chemicals company posted impressive third-quarter sales of £425 million ($569.88 million), reflecting a 6.5% increase on a constant-currency basis. Despite ongoing challenges, Croda reaffirmed its full-year outlook for 2025, projecting adjusted pretax profits between £265 million and £295 million. The firm also aims to achieve annualised cost savings of £100 million by the end of 2027 to strengthen margins. While Thursday’s gains provided a boost, Croda’s stock remains down roughly 17.9% for the year.

In the FTSE 250, XPS Pensions Group climbed 2.2% to 354p, making it one of the index's top performers, despite the FTSE 250 slipping 0.18%. The pensions consulting and administration firm reported a 13% increase in revenue for the first half of the year, including 8% organic growth. Shore Capital analyst Vivek Raja described the results as "better than expected", with revenue hitting £128 million ($171.8 million), surpassing the £126 million forecast. The company remains confident in meeting its full-year targets. Year-to-date, XPS shares have risen 2.64%.

On the downside, Whitbread, the parent company of Premier Inn, saw its shares tumble by as much as 8.56% to 2,948p, marking it as the biggest loser on the FTSE 100, which dipped 0.18%. The hospitality giant reported a first-half adjusted profit before tax of £316 million ($423.91 million), down from £340 million a year earlier. Additionally, Whitbread slashed its full-year profit guidance for its German division to £5 million, down from the previously forecasted range of £5 million to £10 million. Analysts at Hargreaves Lansdown noted that "weaker-than-expected results from its fledgling German operations, coupled with UK economic uncertainty, make the near-term outlook challenging." Despite Thursday’s drop, Whitbread shares are up nearly 9.5% year-to-date, though they still lag behind the FTSE's 15.2% rise.

.

Technical & Trade View

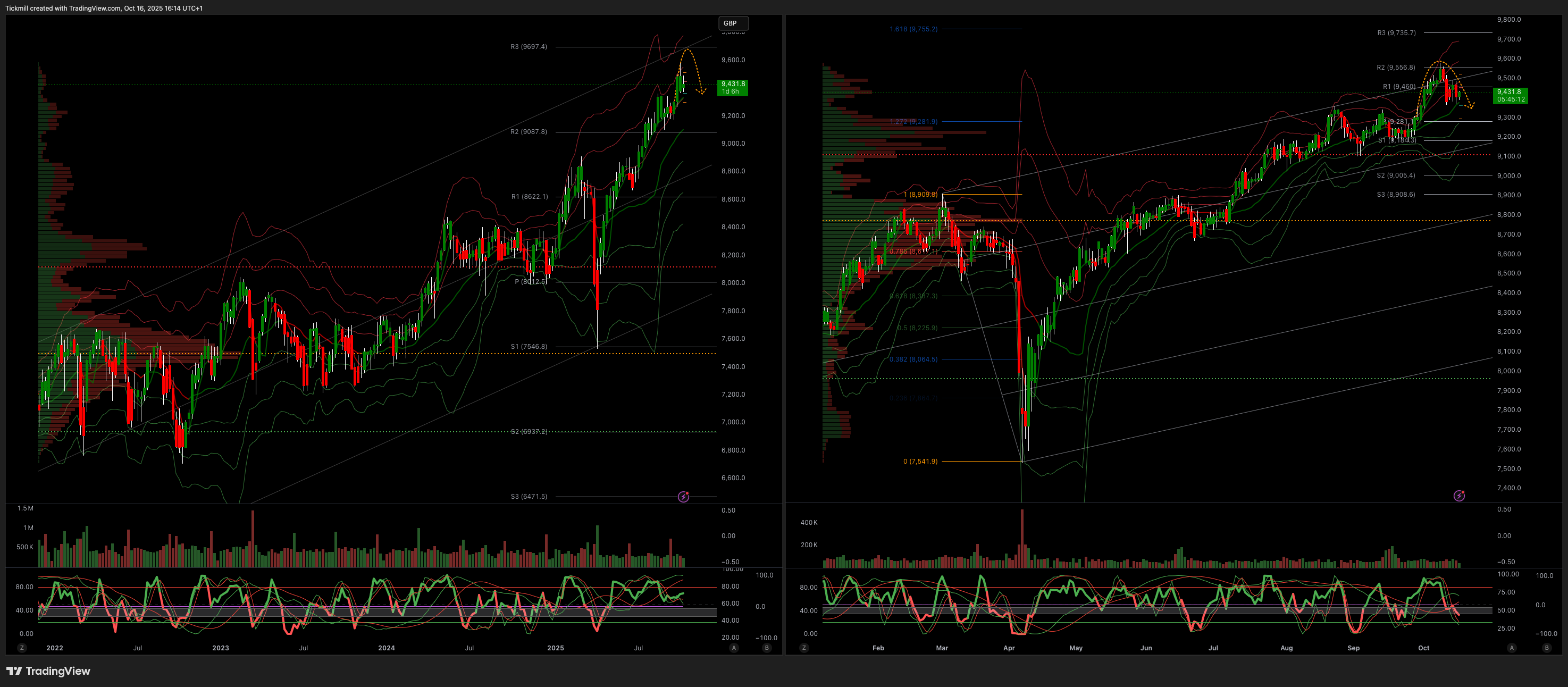

FTSE Bias: Bullish Above Bearish below 9330

Primary support 9000

Below 9300 opens 9000

Primary objective 9600

Daily VWAP Bearish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!