FTSE 100 FINISH LINE 9/10/25

FTSE 100 FINISH LINE 9/10/25

The FTSE 100 in London pulled back on Thursday after hitting a record high in the previous session. A slump in HSBC shares dragged the banking sector lower, but rising mining stocks helped limit the overall losses. HSBC witnessed a sharp drop of 6%, marking its steepest single-day plunge in over six months. The bank announced plans to acquire minority stakes in Hong Kong's Hang Seng Bank, where it already holds a majority share, in a deal valued at HK$106.1 billion ($13.63 billion). The wider banking sector struggled, dragging the market down with a 3.3% decline. Lloyds Banking Group fell by 2.6% after revealing it would need to allocate additional funds to address costs linked to a motor finance scandal. Meanwhile, Close Brothers, a merchant bank, tumbled 4.4%, landing at the bottom of the FTSE 250. Homebuilders also faced challenges, with the sector slipping 1.5%. Taylor Wimpey and Barratt Redrow saw notable dips of 4.3% and 3.3%, respectively. Adding to the sector's woes, a survey by the Royal Institution of Chartered Surveyors highlighted that Britain's housing market has lost steam for the third month in a row, with buyer demand and agreed sales remaining in negative territory throughout September. However, there was a silver lining for base metal miners, who climbed 0.9% thanks to rising copper prices. Anglo American shone as one of the top performers on the FTSE 100, enjoying a 1.8% boost. The FTSE 100 has been soaring to unprecedented heights this week, driven by a surge in resource-related stocks and banks. On Friday, it achieved its most impressive weekly performance since October 2008, as renewed enthusiasm for pharmaceutical stocks helped them recover some of the ground lost earlier this year. Meanwhile, shares of Secure Trust Bank took a hit, dropping 19% after the bank announced that its annual underlying profit before tax is likely to come in below market forecasts.

Two-year gilt yields are nearing a four-month high after Bank of England policymaker Catherine Mann emphasised that inflation expectations remain stubbornly elevated, signalling the need for further policy adjustments. While things appear calm on the surface, UK economic sentiment is showing signs of strain. Surveys highlight a struggling housing market and declining employer confidence, largely driven by budget-related concerns. However, speculation around an expansive November budget is helping maintain the positive link between long-term gilt prices and sterling, offering a glimmer of hope amidst the challenges.

HSBC saw its shares drop by 6% in London, retreating from near-record highs. The decline followed the announcement of the bank's ambitious $13.6 billion plan to acquire minority stakes in its Hang Seng Bank subsidiary, where it already holds a majority share.HSBC is setting its sights on expanding through strategic acquisitions, according to the bank's CEO, Georges Elhedery. Elhedery shared the news of the bank's plans to fully acquire the remaining shares of Hang Seng Bank. "We generate strong capital and have the financial capacity to pursue acquisitions," Elhedery stated, highlighting that key areas for growth include Hong Kong, the UK, transaction banking, and wealth management. At the same time, he emphasized that HSBC will continue to streamline its operations by selling off non-core assets over the next year as part of its broader strategy.

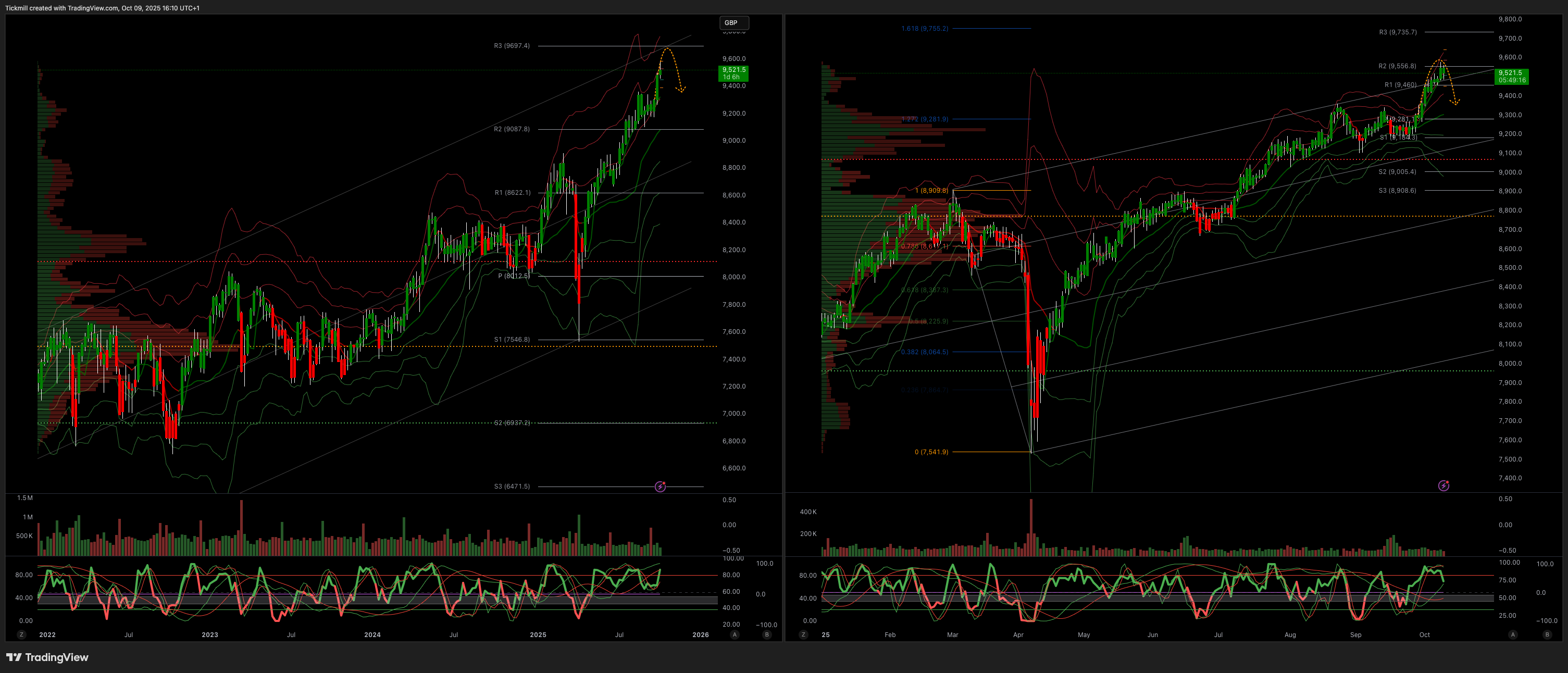

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9300

Primary support 9000

Below 9300 opens 9000

Primary objective 9600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!