Institutional Insights: Citi CTA Update Positioning & Key Levels

.jpeg)

Institutional Insights: Citi CTA Update Positioning & Key Levels

Citi CTA Update

Main Takeaways: Commodity Trading Advisors (CTAs) are being signalled to buy global duration and the U.S. dollar due to recent risk-off movements stemming from heightened trade tensions between the U.S. and China. Our model indicates that funds have shifted to buying duration in European sovereigns, joining their existing "max long" position in U.S. Treasuries. The recent rally in the U.S. dollar has prompted CTAs to adopt a long or "max long" position in all six foreign exchange pairs we monitor for the first time since early March.

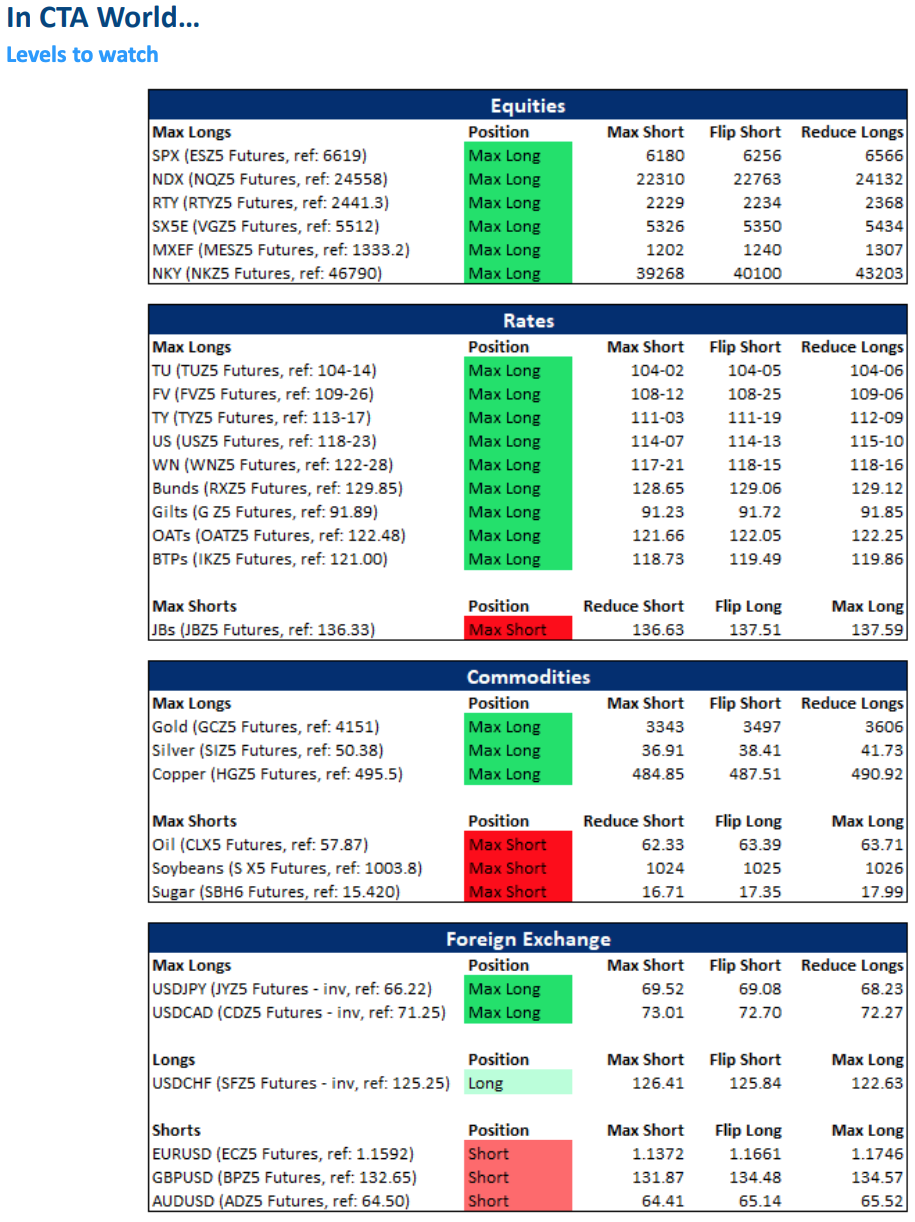

In equities, despite the recent selloff, the S&P 500 (SPX) has not yet reached the level that would trigger a reduction in long positions, currently at 6,566 (down 0.8% from 6,619). CTAs remain "max long" U.S. equities, but the first sell signals are now closer to current levels. The critical level for reducing long positions in SPX is 6,566, while for the Nasdaq 100 (NDX) and Russell 2000 (RTY), the levels are 24,132 (down 1.7% from 24,558) and 2,368 (down 3% from 2,441), respectively. Internationally, CTAs are also "max long" in emerging markets and Europe, with sell signals close at 5,434 in SX5E (down 1.4% from 5,512) and 1,307 in MXEF (down 2% from 1,333). In Japan, CTAs maintain a "max long" position in the Nikkei (NKY), with over 7% between current levels and the first sell signal.

In rates, CTAs are "max long" U.S. Treasuries as the current risk-off rally moves away from sell levels. The signal to reduce length is now at 112-09 in TY (reference 113-17). In Europe, where CTAs have a long-standing "max short" position in duration, signals are emerging to flip to long and add to their positions as the global rally continues. Funds are now buyers of duration in Bunds, Gilts, and OATs this week and next, transitioning into "max long" positions. However, in Japanese Government Bonds (JGBs), CTAs still hold a short position, with the cover level at 136.63 (reference 136.33).

In commodities, CTAs have extended their positions as oil tests year-to-date lows, with the signal to cover their "max short" position now over 7% away at 62.33 (reference 57.87). For gold and silver, the first sell levels to reduce "max long" positions are -13% and -17% away from current levels, respectively. In copper, the sell level is much closer, with funds currently "max long" and expected to trim positions below 490.92 (reference 495.50).

In foreign exchange, CTAs are now "max long" the U.S. dollar across all six tracked pairs for the first time since March 3, 2025, following the continued dollar rally that broke through final long flip signals. Funds are "max long" in USD/JPY and USD/CAD, with room to increase positions in other pairs. Key levels to watch for adding to long positions include 1.1372 in EUR/USD (reference 1.1592), 131.87 in GBP/USD (reference 132.65), 122.63 in USD/CHF (reference 125.25), and 64.41 in AUD/USD (reference 64.50).

*Citi Equity Derivatives’ CTA model categorizes positioning into four regimes: "max short," "moderately short," "moderately long," and "max long." A "max long" or "max short" designation does not imply that positioning has reached historical extremes.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!