US Stocks Rally Shutdown Optimism

Shutdown Progress

US stocks look poised for a fresh move higher today as traders welcome signs that the US govt shutdown is finally coming to an end. Talks over the weekend between US senators resulted in a compromise bill gaining support from both Republicans and Democrats in the Senate. The move is the first procedural step on the way to ending the shutdown. After receiving enough support to be put forward, the bill will now have to pass through the House of Representatives. However, with markets sensing that sentiment is turning in favour of ending the shutdown, particularly with the Thanksgiving holiday ahead, there is a definite risk on tone with both the Nasdaq and S&P higher pre-market. Any further positive headlines this week should provide fresh upside impetus for stocks.

Trump Stimulus Plans

With the prospect of the US govt shutdown coming to an end, and with Fed easing back in focus following disappointing US data last week, near-term risks have turned back to the upside. Indeed, news also that Trump plans to grant US citizens (excluding high earners) a $2000 stimulus cheque on the back of tariff profits, is also feeding into bullish equities sentiment here. Prior stimulus payments have typically yielded higher equities prices through increased trading and investment activity. If markets receive confirmation this is going ahead, stocks are likely to push higher again.

Technical Views

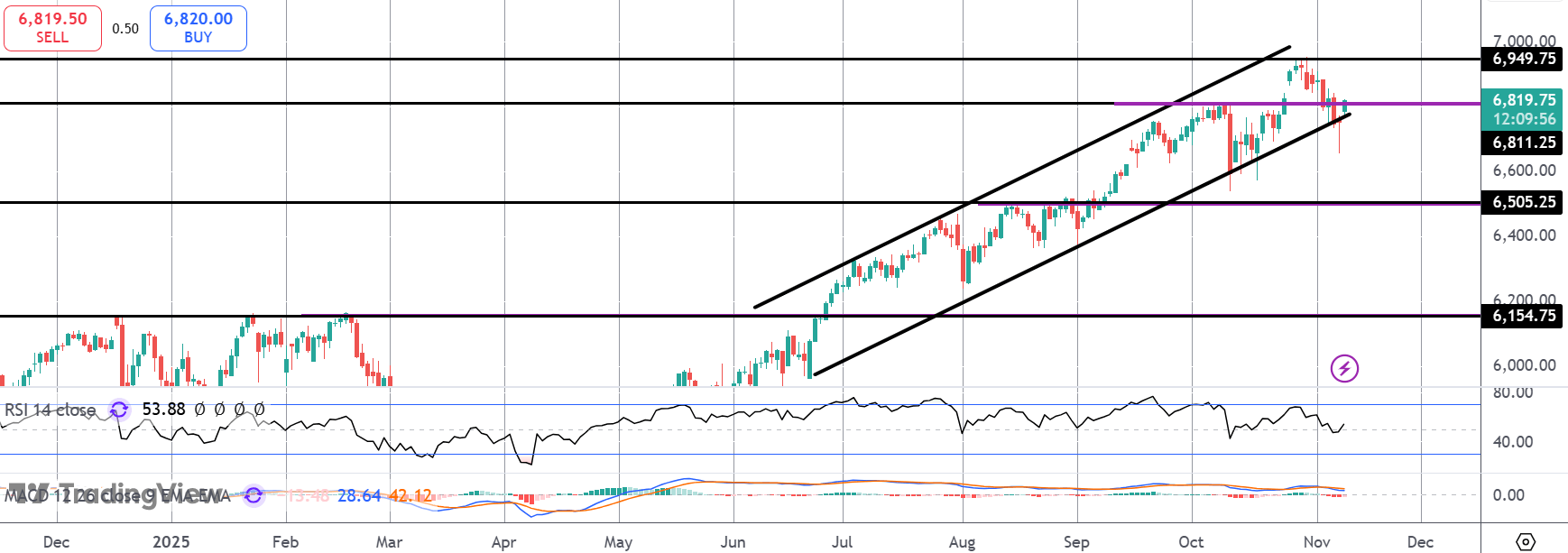

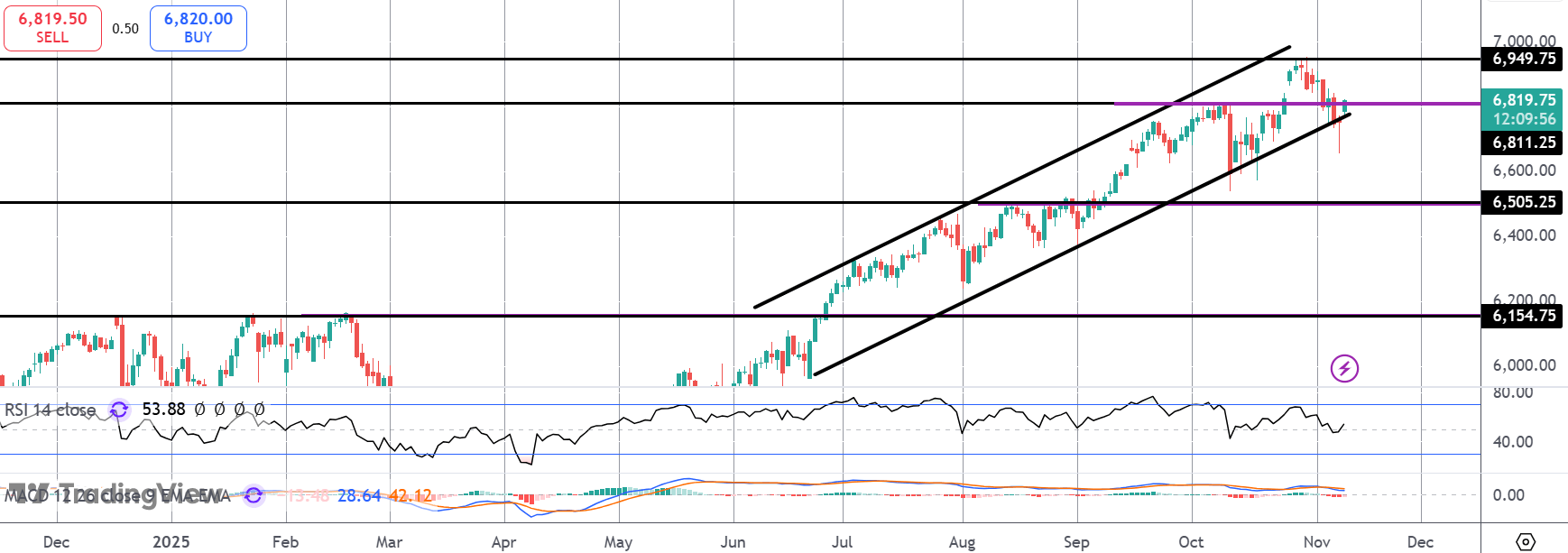

S&P Futures

The correction lower in the S&P has seen the market briefly piercing below the bullish channel before reversing higher to close back inside the structure. Price is now fighting get back above the 6,811.25 level. For now, focus is on a rebound higher and a resumption of the bull trend with the 6,949.75 YTD highs the first objective or bulls ahead of a fresh breakout.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.